Are Fixed Costs That Management Has Little Or No Control Over In The Short Run.

Building Blocks of Managerial Accounting

9 Identify and Employ Bones Toll Behavior Patterns

Now that nosotros take identified the 3 cardinal types of businesses, let's place price behaviors and apply them to the business surroundings. In managerial accounting, different companies use the term toll in different means depending on how they volition use the cost information. Unlike decisions crave dissimilar costs classified in different ways. For example, a manager may need toll information to plan for the coming twelvemonth or to make decisions about expanding or discontinuing a product or service. In practice, the nomenclature of costs changes equally the use of the cost information changes. In fact, a single price, such every bit rent, may be classified past one company as a fixed cost, past some other company as a committed cost, and by even another company every bit a period toll. Understanding unlike toll classifications and how certain costs tin exist used in different means is disquisitional to managerial accounting.

Establish of Management Accountants and Certified Management Accountant Certification

Managerial accountants provide businesses with clear and straight insight into the monetary effects of any detail operational action under consideration. They are expected to report financial data in a transparent and upstanding manner. The Found of Management Accountants (IMA) offers the Certified Management Accountant (CMA) certification. IMA members and CMAs concur to uphold a set of ethical principles that includes honesty, fairness, objectivity, and responsibility. Whatsoever managerial accountant, even if not an IMA fellow member or certified CMA, should act in accordance with these principles and encourage coworkers to follow ethical principles for reporting financial results and monetary effects of financial decisions related to their organization. The IMA Committee on Ideals encourages organizations and individuals to adopt, promote, and execute business organisation practices consistent with high upstanding standards.i

Major Cost Behavior Patterns

Any discussion of costs begins with the understanding that near costs will be classified in one of 3 ways: stock-still costs, variable costs, or mixed costs. The costs that don't fall into one of these iii categories are hybrid costs, which are examined simply briefly because they are addressed in more than avant-garde accounting courses. Because stock-still and variable costs are the foundation of all other cost classifications, agreement whether a cost is a fixed cost or a variable cost is very important.

Stock-still versus Variable Costs

A fixed cost is an unavoidable operating expense that does non modify in total over the short term, fifty-fifty if a business experiences variation in its level of action. (Figure) illustrates the types of fixed costs for merchandising, service, and manufacturing organizations.

| Examples of Fixed Costs | |

|---|---|

| Type of Business | Fixed Cost |

| Merchandising | Rent, insurance, managers' salaries |

| Manufacturing | Property taxes, insurance, equipment leases |

| Service | Rent, straight-line depreciation, administrative salaries, and insurance |

We have established that stock-still costs exercise not change in total as the level of action changes, but what about fixed costs on a per-unit basis? Permit's examine Tony'south screen-press company to illustrate how costs can remain fixed in total just modify on a per-unit basis.

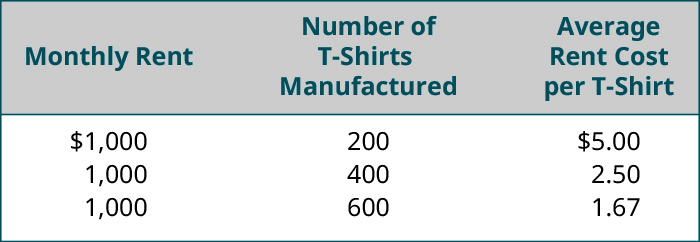

Tony operates a screen-press company, specializing in custom T-shirts. One of his fixed costs is his monthly rent of ?one,000. Regardless of whether he produces and sells whatsoever T-shirts, he is obligated under his lease to pay ?1,000 per month. However, he can consider this fixed cost on a per-unit of measurement basis, as shown in (Figure).

Individual Rent Cost per T-Shirt Produced. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

Tony's information illustrates that, despite the unchanging stock-still price of rent, as the level of activity increases, the per-unit fixed cost falls. In other words, stock-still costs remain fixed in total but tin can increase or decrease on a per-unit of measurement basis.

2 specialized types of fixed costs are committed fixed costs and discretionary fixed costs. These classifications are generally used for long-range planning purposes and are covered in upper-level managerial accounting courses, so they are only briefly described hither.

Committed stock-still costs are fixed costs that typically cannot be eliminated if the company is going to continue to part. An example would exist the charter of factory equipment for a production company.

Discretionary fixed costs more often than not are stock-still costs that can exist incurred during some periods and postponed during other periods but which cannot normally be eliminated permanently. Examples could include advert campaigns and employee training. Both of these costs could potentially be postponed temporarily, simply the company would probably incur negative effects if the costs were permanently eliminated. These classifications are mostly used for long-range planning purposes.

In improver to understanding fixed costs, it is critical to understand variable costs, the second fundamental cost classification. A variable price is ane that varies in direct proportion to the level of activity inside the business. Typical costs that are classified equally variable costs are the cost of raw materials used to produce a product, labor applied directly to the production of the product, and overhead expenses that modify based upon activity. For each variable toll, in that location is some activity that drives the variable cost up or downwardly. A toll driver is defined as whatever action that causes the organization to incur a variable toll. Examples of cost drivers are directly labor hours, automobile hours, units produced, and units sold. (Figure) provides examples of variable costs and their associated cost drivers.

| Variable Costs and Associated Toll Drivers | ||

|---|---|---|

| Variable Cost | Cost Driver | |

| Merchandising | Full monthly hourly wages for sales staff | Hours business organisation is open up during month |

| Manufacturing | Direct materials used to produce one unit of production | Number of units produced |

| Service | Price of laundering linens and towels | Number of hotel rooms occupied |

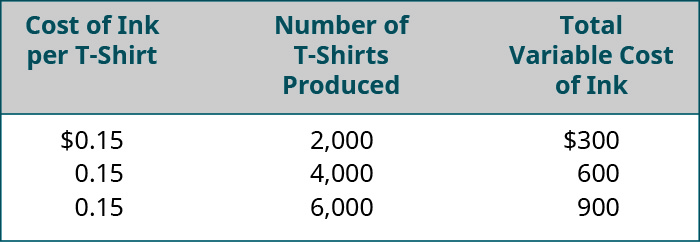

Unlike fixed costs that remain fixed in total but change on a per-unit of measurement basis, variable costs remain the same per unit, but change in full relative to the level of activity in the business concern. Revisiting Tony's T-Shirts, (Effigy) shows how the variable price of ink behaves as the level of activeness changes.

Variable Costs per Unit of measurement. (attribution: Copyright Rice University, OpenStax, nether CC BY-NC-SA iv.0 license)

As (Figure) shows, the variable price per unit (per T-shirt) does not alter as the number of T-shirts produced increases or decreases. However, the variable costs change in total every bit the number of units produced increases or decreases. In short, total variable costs rise and fall as the level of activity (the cost driver) rises and falls.

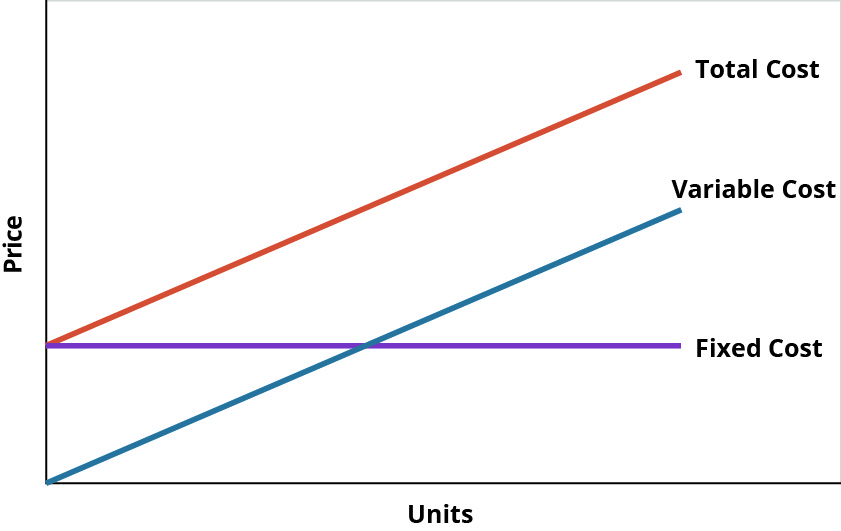

Distinguishing between fixed and variable costs is critical because the full toll is the sum of all fixed costs (the total stock-still costs) and all variable costs (the full variable costs). For every unit produced, every customer served, or every hotel room rented, for instance, managers can make up one's mind their total costs both per unit of activeness and in total by combining their fixed and variable costs together. The graphic in (Effigy) illustrates the concept of total costs.

Total Toll as the Sum of Total Fixed Costs and Total Variable Costs. (attribution: Copyright Rice University, OpenStax, nether CC Past-NC-SA 4.0 license)

Remember that the reason that organizations have the time and effort to classify costs as either fixed or variable is to be able to control costs. When they allocate costs properly, managers tin can utilise cost data to make decisions and plan for the hereafter of the business organisation.

Boeing2

If you've ever flown on an plane, there's a proficient take chances y'all know Boeing. The Boeing Company generates effectually ?90 billion each year from selling thousands of airplanes to commercial and armed services customers around the earth. It employs around 200,000 people, and it's indirectly responsible for more than a meg jobs through its suppliers, contractors, regulators, and others. Its main assembly line in Everett, WA, is housed in the largest building in the world, a colossal facility that covers most a half-trillion cubic feet. Boeing is, simply put, a massive enterprise.

And however, Boeing's managers know the verbal toll of everything the company uses to produce its airplanes: every propeller, flap, seat belt, welder, computer programmer, and so forth. Moreover, they know how those costs would change if they produced more airplanes or fewer. They also know the cost at which they sold each plane and the turn a profit the company made on each sale. Boeing's executives wait their managers to know this information, in real fourth dimension, if the company is to remain profitable.

| Link between Business Conclusion and Cost Information Utilized | |

|---|---|

| Conclusion | Cost Data |

| Discontinue a product line | Variable costs, overhead direct tied to product, potential reduction in fixed costs |

| Add together second production shift | Labor costs, cost of fringe benefits, potential overhead increases (utilities, security personnel) |

| Open boosted retail outlets | Stock-still costs, variable operating costs, potential increases in authoritative expenses at corporate headquarters |

Boilerplate Fixed Costs versus Average Variable Costs

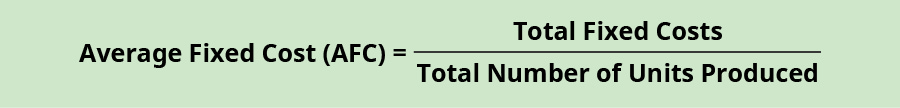

Another way management may desire to consider their costs is as average costs. Under this arroyo, managers can calculate both boilerplate fixed and average variable costs. Average fixed cost (AFC) is the total stock-still costs divided by the total number of units produced, which results in a per-unit price. The formula is:

To show how a company would use AFC to make concern decisions, consider Carolina Yachts, a company that articles sportfishing boats that are sold to consumers through a network of marinas and boat dealerships. Carolina Yachts produces 625 boats per yr, and their total annual fixed costs are ?1,560,000. If they desire to determine an boilerplate stock-still cost per unit, they will find it using the formula for AFC:

\(\text{AFC}=\frac{?1,560,000}{625}=?2,496\phantom{\dominion{0.2em}{0ex}}\text{per boat}\)

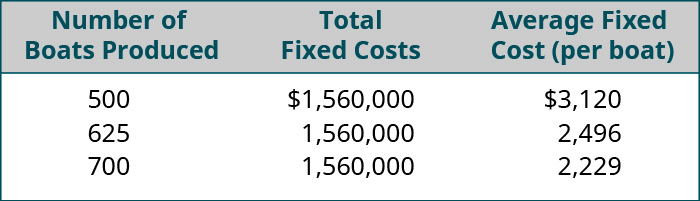

When they produce 625 boats, Carolina Yachts has an AFC of ?ii,496 per gunkhole. What happens to the AFC if they increase or decrease the number of boats produced? (Figure) shows the AFC for dissimilar numbers of boats.

Average Fixed Costs for Carolina Yachts. (attribution: Copyright Rice University, OpenStax, nether CC By-NC-SA 4.0 license)

Nosotros see that full fixed costs remain unchanged, just the boilerplate stock-still cost per unit goes upwardly and down with the number of boats produced. As more units are produced, the fixed costs are spread out over more units, making the fixed toll per unit fall. Besides, as fewer boats are manufactured, the boilerplate fixed costs per unit rises. Nosotros can use a similar approach with variable costs.

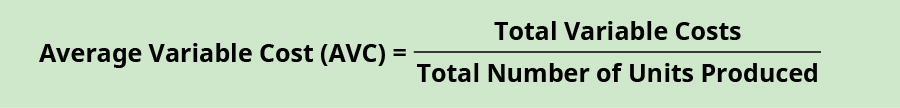

Average variable cost (AVC) is the total variable costs divided by the total number of units produced, which results in a per-unit price. Like ATC, nosotros tin utilise this formula:

To demonstrate AVC, let's return to Carolina Yachts, which incurs total variable costs of ?6,875,000 when they produce 625 boats per year. They can express this as an average variable cost per unit:

\(\text{AVC}=\frac{?6,875,000}{625}=?11,000\phantom{\rule{0.2em}{0ex}}\text{per boat}\)

Because average variable costs are the average of all costs that change with production levels on a per-unit basis and include both direct materials and direct labor, managers often utilize AVC to determine if product should continue or not in the short run. As long as the price Carolina Yachts receives for their boats is greater than the per-unit AVC, they know that they are not only covering the variable toll of production, merely each boat is making a contribution toward covering stock-still costs. If, at whatever bespeak, the average variable price per boat rises to the point that the price no longer covers the AVC, Carolina Yachts may consider halting production until the variable costs autumn once again.

These changes in variable costs per unit could be caused by circumstances beyond their control, such as a shortage of raw materials or an increase in shipping costs due to high gas prices. In any case, average variable price tin can be useful for managers to go a big motion-picture show wait at their variable costs per unit of measurement.

Mixed Costs and Stepped Costs

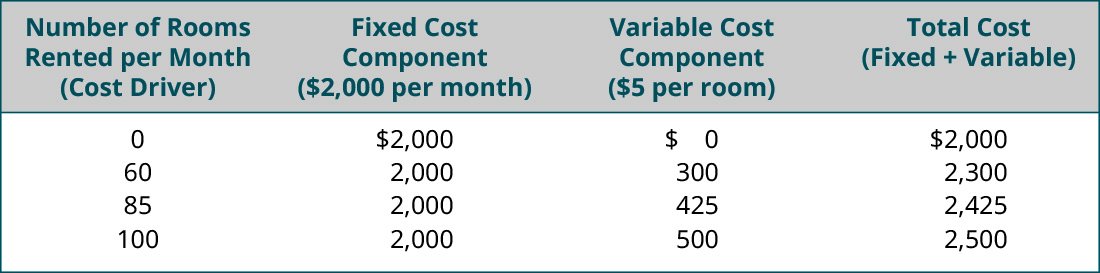

Not all costs can be classified equally purely fixed or purely variable. Mixed costs are those that have both a fixed and variable component. It is important, however, to be able to dissever mixed costs into their stock-still and variable components because, typically, in the short run, we can only change variable costs just not most fixed costs. To examine how these mixed costs actually work, consider the Bounding main Cakewalk hotel.

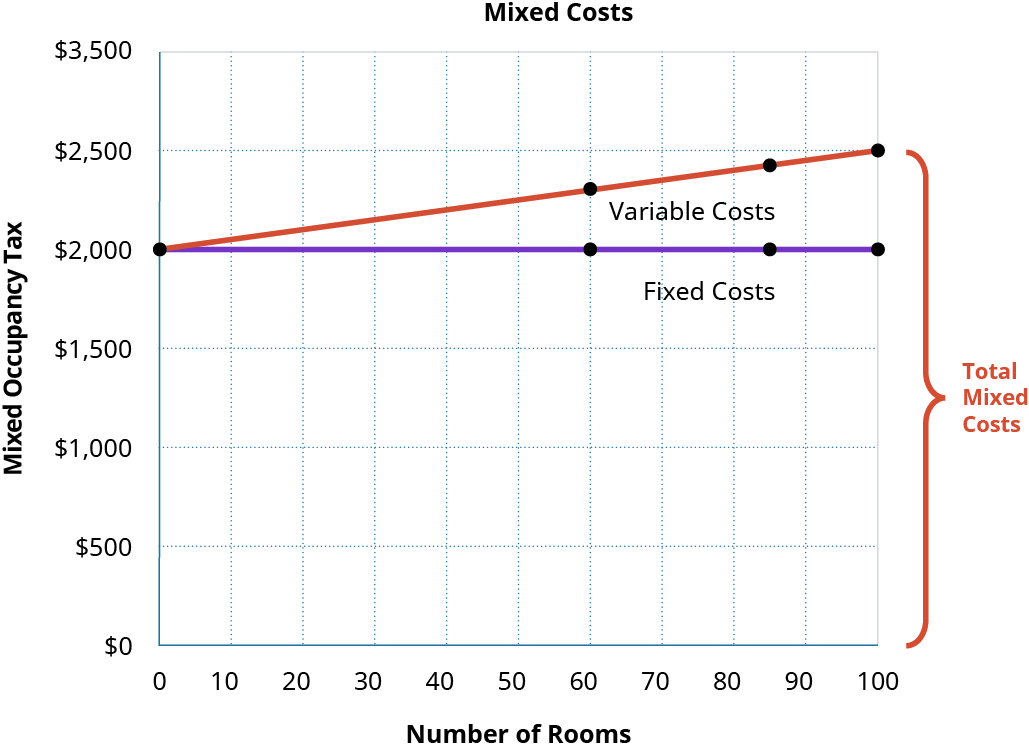

The Ocean Cakewalk is located in a resort area where the county assesses an occupancy tax that has both a fixed and a variable component. Body of water Breeze pays ?two,000 per month, regardless of the number of rooms rented. Fifty-fifty if it does non rent a unmarried room during the month, Ocean Cakewalk still must remit this tax to the county. The hotel treats this ?2,000 as a stock-still price. However, for every dark that a room is rented, Ocean Breeze must remit an additional tax corporeality of ?v.00 per room per night. As a result, the occupancy tax is a mixed cost. (Figure) further illustrates how this mixed cost behaves.

Mixed Costs Case for Ocean Breeze. (attribution: Copyright Rice University, OpenStax, under CC Past-NC-SA 4.0 license)

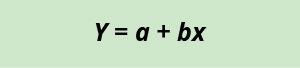

Notice that Bounding main Breeze cannot control the fixed portion of this toll and that it remains fixed in total, regardless of the activity level. On the other hand, the variable component is fixed per unit, but changes in total based upon the level of activeness. The stock-still portion of this cost plus the variable portion of this cost combine to make the total cost. As a result, the formula for total cost looks like this:

where Y is the total mixed price, a is the fixed cost, b is the variable toll per unit of measurement, and ten is the level of action.

Graphically, mixed costs tin be explained as shown in (Figure).

Body of water Breeze's Mixed Cost Graph. (attribution: Copyright Rice Academy, OpenStax, under CC By-NC-SA 4.0 license)

The graph shows that mixed costs are typically both stock-still and linear in nature. In other words, they will often have an initial cost, in Ocean Breeze's case, the ?ii,000 fixed component of the occupancy tax, and a variable component, the ?five per night occupancy revenue enhancement. Annotation that the Bounding main Cakewalk mixed cost graph starts at an initial ?two,000 for the fixed component then increases by ?5 for each night their rooms are occupied.

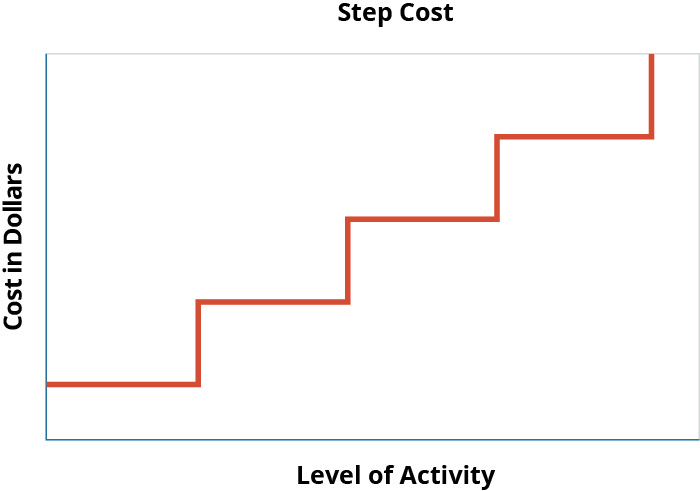

Some costs behave less linearly. A cost that changes with the level of activeness simply is not linear is classified as a stepped cost. Step costs remain constant at a fixed amount over a range of action. The range over which these costs remain unchanged (fixed) is referred to as the relevant range, which is divers as a specific activity level that is bounded by a minimum and maximum corporeality. Inside this relevant range, managers can predict revenue or cost levels. And so, at certain points, the step costs increase to a higher amount. Both stock-still and variable costs tin can take on this stair-pace behavior. For instance, wages often act as a stepped variable cost when employees are paid a flat salary and a committee or when the company pays overtime. Further, when additional machinery or equipment is placed into service, businesses will run across their fixed costs stepped upwardly. The "trigger" for a cost to stride upwards is the relevant range. Graphically, pace costs appear like stair steps ((Effigy)).

Step Cost Graph. (attribution: Copyright Rice Academy, OpenStax, under CC BY-NC-SA iv.0 license)

For case, suppose a quality inspector tin can audit a maximum of 80 units in a regular 8-hour shift and his salary is a fixed price. Then the relevant range for QA inspection is from 0–80 units per shift. If demand for these units increases and more than than eighty inspections are needed per shift, the relevant range has been exceeded and the business volition accept 1 of two choices:

(one) Pay the quality inspector overtime in order to have the boosted units inspected. This overtime will "step upward" the variable cost per unit. The advantage to handling the increased price in this way is that when demand falls, the cost tin quickly be "stepped down" again. Because these types of step costs can be adjusted quickly and often, they are often still treated as variable costs for planning purposes.

(2) "Step upwards" fixed costs. If the visitor hires a second quality inspector, they would be stepping up their fixed costs. In effect, they will double the relevant range to allow for a maximum of 160 inspections per shift, assuming the second QA inspector tin can audit an additional lxxx units per shift. The downward side to this approach is that once the new QA inspector is hired, if demand falls over again, the company will be incurring fixed costs that are unnecessary. For this reason, adding salaried personnel to address a brusk-term increase in demand is not a decision most businesses make.

Step costs are all-time explained in the context of a business concern experiencing increases in activity across the relevant range. As an example, let's return to Tony's T-Shirts.

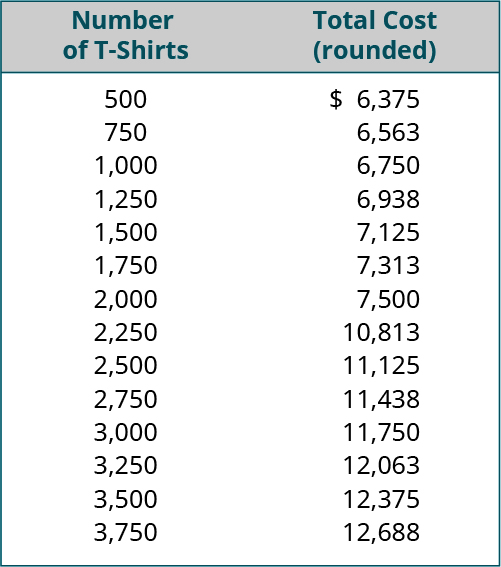

Tony's toll of operations and the associated relevant ranges are shown in (Effigy).

| Tony's T-Shirts Cost Options | |||

|---|---|---|---|

| Cost | Type of Toll | Relevant Range | |

| Charter on Screen-Printing Machine | ?2,000 per month | Fixed | 0–2,000 T-shirts per calendar month |

| Employee | ?10 per hour | Variable | 20 shirts per hour |

| Tony'due south Salary | ?2,500 per month | Stock-still | N/A |

| Screen-Printing Ink | ?0.25 per shirt | Variable | N/A |

| Building Hire | ?1,500 per calendar month | Fixed | ii screen-press machines and 2 employees |

Every bit you can run into, Tony has both fixed and variable costs associated with his business. His one screen-press car can only produce two,000 T-shirts per month and his current employee can produce 20 shirts per hour (160 per 8-hour work day). The space that Tony leases is large enough that he could add an additional screen-printing machine and ane additional employee. If he expands across that, he will need to charter a larger space, and presumably his rent would increment at that point. Information technology is easy for Tony to predict his costs as long as he operates within the relevant ranges by applying the total cost equation Y = a + bx. So, for Tony, as long every bit he produces two,000 or fewer T-shirts, his total cost volition be constitute by Y = ?6,000 + ?0.75x, where the variable price of ?0.75 is the ?0.25 cost of the ink per shirt and ?0.50 per shirt for labor (?10 per hour wage/20 shirts per hr). As before long as his production passes the ii,000 T-shirts that his ane employee and one machine can handle, he will have to add together a 2d employee and lease a second screen-printing machine. In other words, his fixed costs volition rising from ?vi,000 to ?eight,000, and his variable cost per T-shirt volition ascent from ?0.75 to ?1.25 (ink plus two workers). Thus, his new price equation is Y = ?8,000 + ?1.25x until he "steps up" again and adds a third machine and moves to a new location with a presumably college hire. Let's accept a await at this in nautical chart form to better illustrate the "step" in cost Tony will experience every bit he steps past 2,000 T-shirts.

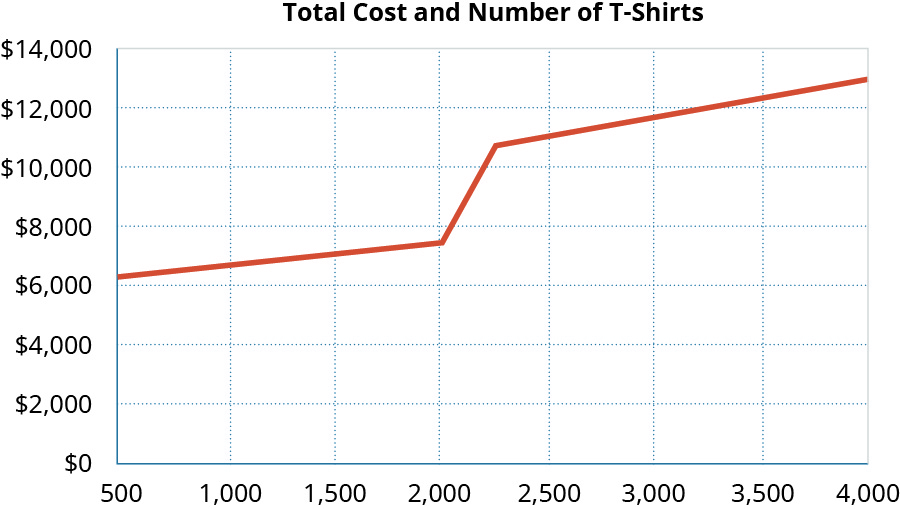

Tony's cost information is shown in the chart for volume betwixt 500 and 4,000 shirts.

When presented graphically, detect what happens when Tony steps outside of his original relevant range and has to add a 2nd employee and a second screen-printing machine:

Stepped Variable Costs for Tony'southward T-Shirts. (attribution: Copyright Rice University, OpenStax, nether CC By-NC-SA 4.0 license)

It is important to call back that even though Tony'south costs stepped upwards when he exceeded his original capacity (relevant range), the behavior of the costs did not alter. His fixed costs still remained fixed in total and his total variable cost rose as the number of T-shirts he produced rose. (Figure) summarizes how costs behave within their relevant ranges.

| Summary of Fixed and Variable Toll Behaviors | ||

|---|---|---|

| Cost | In Total | Per Unit |

| Variable Cost | Changes in response to the level of action | Remains fixed per unit regardless of the level of activity |

| Fixed Cost | Does not alter with the level of activity, within the relevant range, just does change when the relevant range changes | Changes based upon activity within the relevant range: increased activity decreases per-unit toll; decreased activity increases per-unit cost |

Product versus Catamenia Costs

Many businesses can brand decisions by dividing their costs into fixed and variable costs, simply there are some business decisions that require grouping costs differently. Sometimes companies need to consider how those costs are reported in the financial statements. At other times, companies group costs based on functions inside the business. For instance, a business would grouping administrative and selling expenses past the period (monthly or quarterly) so that they can be reported on an Income Statement. However, a manufacturing business firm may carry product costs such as materials from one menstruation to the other in society to accept the costs "travel" with the units being produced. Information technology is possible that both the selling and administrative costs and materials costs accept both fixed and variable components. As a result, it may be necessary to analyze some fixed costs together with some variable costs. Ultimately, businesses strategically group costs in order to make them more useful for decision-making and planning. 2 of the broadest and about common grouping of costs are product costs and period costs.

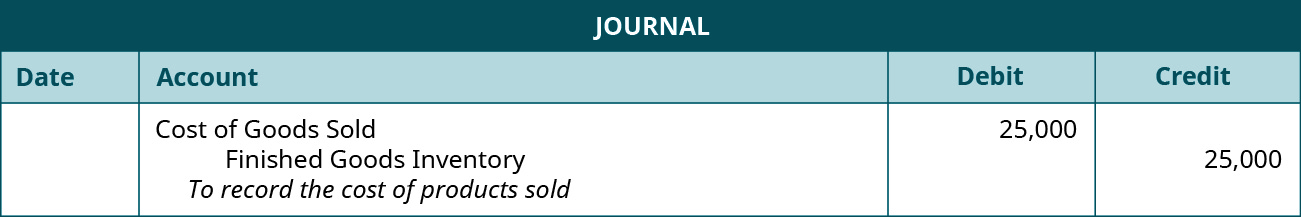

Product costs are all those associated with the acquisition or production of goods and products. When products are purchased for resale, the cost of goods is recorded as an asset on the company's residuum sheet. It is not until the products are sold that they go an expense on the income statement. By moving production costs to the expense account for the price of goods sold, they are easily matched to the sales revenue income account. For example, Bert's Bikes is a wheel retailer who purchases bikes from several wholesale distributors and manufacturers. When Bert purchases bicycles for resale, he places the cost of the bikes into his inventory account, considering that is what those bikes are—his inventory available for sale. It is non until someone purchases a bike that it creates sales revenue, and in order to fulfill the requirements of double-entry accounting, he must friction match that income with an expense: the toll of goods sold ((Figure)).

Periodical Entry for Cost of Goods Sold. Product costs are collected in the finished goods inventory, where they remain until the appurtenances are sold. (attribution: Copyright Rice University, OpenStax, nether CC Past-NC-SA 4.0 license)

Some production costs have both a fixed and variable component. For instance, Bert purchases ten bikes for ?100 each. The distributor charges ?x per bike for shipping for 1 to 10 bikes simply ?eight per bicycle for xi to xx bikes. This shipping cost is fixed per unit but varies in total. If Bert wants to save coin and command his cost of appurtenances sold, he tin society an 11th bicycle and driblet his shipping cost by ?two per bicycle. Information technology is important for Bert to know what is fixed and what is variable so that he can command his costs as much as possible.

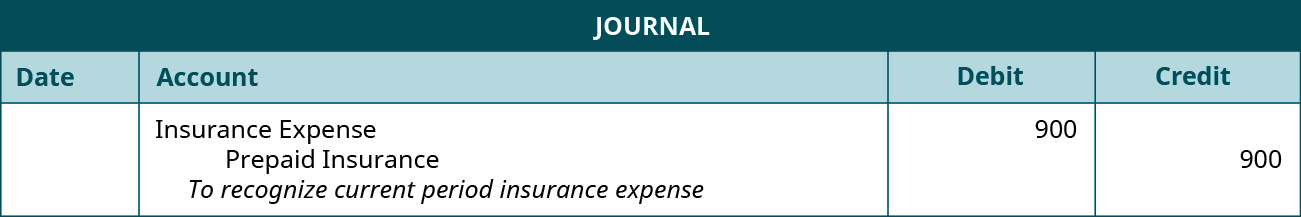

What well-nigh the costs Bert incurs that are not product costs? Period costs are but all of the expenses that are not product costs, such as all selling and administrative expenses. Information technology is important to call back that period costs are treated equally expenses in the period in which they occur. In other words, they follow the rules of accrual accounting do past recognizing the cost (expense) in the menstruum in which they occur regardless of when the cash changes hands. For example, Bert pays his business organisation insurance in January of each year. Bert's annual insurance premium is ?10,800, which is ?900 per month. Each month, Bert will recognize 1/12 of this insurance price as an expense in the flow in which it is incurred ((Figure)).

Journal Entry for Insurance Expense. Bert applies 1/12 of the prepaid insurance premium per calendar month to the expense account in order to match period costs with period revenues. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

Why is it then important for Bert to know which costs are product costs and which are menses costs? Bert may accept little command over his product costs, but he maintains a great deal of control over many of his catamenia costs. For this reason, information technology is important that Bert be able to place his menstruum costs and so determine which of them are fixed and which are variable. Think that stock-still costs are fixed over the relevant range, but variable costs change with the level of activity. If Bert wants to control his costs to make his bike business organization more profitable, he must be able to differentiate betwixt the costs he can and cannot control.

Merely similar a merchandising business such as Bert's Bikes, manufacturers also classify their costs as either production costs or period costs. For a manufacturing business, product costs are the costs associated with making the product, and period costs are all other costs. For the purposes of external reporting, separating costs into period and product costs is not all that is necessary. However, for direction decision-making activities, refinement of the types of product costs is helpful.

In a manufacturing firm, the need for management to exist enlightened of the types of costs that make up the cost of a product is of paramount importance. Let'southward expect at Carolina Yachts again and examine how they tin allocate the product costs associated with building their sportfishing boats. Just like automobiles, every year, Carolina Yachts makes changes to their boats, introducing new models to their product line. When the engineers begin to redesign boats for the next year, they must be careful not to make changes that would drive the selling price of their boats too high, making them less bonny to the customer. The engineers need to know exactly what the addition of another feature will do to the cost of production. Information technology is not enough for them to get total product cost data; instead, they need specific information about the three classes of product costs: materials, labor, and overhead.

Equally y'all've learned, direct materials are the raw materials and component parts that are directly economically traceable to a unit of measurement of production.

(Figure) provides some examples of direct materials.

| Examples of Direct Materials | ||

|---|---|---|

| Manufacturing Business organisation | Product | Direct Materials |

| Bakery | Birthday cakes | Flour, sugar, eggs, milk |

| Automobile manufacturer | Cars | Drinking glass, steel, tires, carpet |

| Furniture manufacturer | Recliners | Wood, fabric, cotton wool batting |

In each of the examples, managers are able to trace the toll of the materials directly to a specific unit (block, motorcar, or chair) produced. Since the amount of direct materials required will change based on the number of units produced, straight materials are almost always classified every bit a variable price. They remain fixed per unit of measurement of production but change in total based on the level of activity inside the business organisation.

Information technology takes more than materials for Carolina Yachts to build a gunkhole. It requires the awarding of labor to the raw materials and component parts. Yous've besides learned that direct labor is the work of the employees who are directly involved in the production of goods or services. In fact, for many industries, the largest cost incurred in the product process is labor. For Carolina Yachts, their direct labor would include the wages paid to the carpenters, painters, electricians, and welders who build the boats. Similar direct materials, directly labor is typically treated as a variable cost because it varies with the level of activity. However, in that location are some companies that pay a apartment weekly or monthly salary for production workers, and for these employees, their compensation could be classified as a fixed cost. For case, many auto mechanics are at present paid a flat weekly or monthly salary.

While in the example Carolina Yachts is dependent upon direct labor, the production process for companies in many industries is moving from human labor to a more automated production process. For these companies, direct labor in these industries is condign less meaning. For an example, you lot can research the current product process for the motorcar industry.

The third major nomenclature of product costs for a manufacturing business organisation is overhead. Manufacturing overhead (sometimes referred to as factory overhead) includes all of the costs that a manufacturing business incurs, other than the variable costs of direct materials and directly labor required to build products. These overhead costs are not directly attributable to a specific unit of measurement of production, but they are incurred to support the product of goods. Some of the items included in manufacturing overhead include supervisor salaries, depreciation on the factory, maintenance, insurance, and utilities. Information technology is important to note that manufacturing overhead does not include whatever of the selling or administrative functions of a business concern. For Carolina Yachts, costs like the sales, marketing, CEO, and clerical staff salaries will not be included in the adding of manufacturing overhead costs simply will instead be allocated to selling and administrative expenses.

As yous have learned, much of the power of managerial accounting is its power to break costs down into the smallest possible trackable unit. This also applies to manufacturing overhead. In many cases, businesses have a demand to further refine their overhead costs and volition track indirect labor and indirect materials.

When labor costs are incurred only are not straight involved in the active conversion of materials into finished products, they are classified as indirect labor costs. For example, Carolina Yachts has production supervisors who oversee the manufacturing process but do not actively participate in the structure of the boats. Their wages generally support the production process simply cannot be traced back to a single unit. For this reason, the production supervisors' salary would be classified as indirect labor. Similar to straight labor, on a production or department basis, indirect labor, such as the supervisor'south bacon, is often treated every bit a fixed cost, assuming that it does non vary with the level of activity or number of units produced. Nonetheless, if you are considering the supervisor's salary price on a per unit of measurement of product basis, and so it could be considered a variable cost.

Similarly, non all materials used in the production process can be traced back to a specific unit of product. When this is the example, they are classified equally indirect material costs. Although needed to produce the product, these indirect material costs are not traceable to a specific unit of production. For Carolina Yachts, their indirect materials include supplies like tools, mucilage, wax, and cleaning supplies. These materials are required to build a boat, but direction cannot easily track how much of a bottle of glue they use or how oftentimes they use a particular drill to build a specific boat. These indirect materials and their associated price represent a small fraction of the full materials needed to complete a unit of production. Like directly materials, indirect materials are classified as a variable cost since they vary with the level of product. (Figure) provides some examples of manufacturing costs and their classifications.

| Examples of Classifications of Manufacturing Costs | ||

|---|---|---|

| Price | Classification | Fixed or Variable |

| Product supervisor salary | Indirect labor | Fixed |

| Raw materials used in production | Straight materials | Variable |

| Wages of product employees | Straight labor | Variable |

| Straight-line depreciation on manufacturing plant equipment | Full general manufacturing overhead | Fixed |

| Glue and adhesives | Indirect materials | Variable |

Prime Costs versus Conversion Costs

In sure product environments, one time a business organisation has separated the costs of the product into direct materials, direct labor, and overhead, the costs tin can so be gathered into two broader categories: prime number costs and conversion costs. Prime costs are the directly textile expenses and direct labor costs, while conversion costs are direct labor and general factory overhead combined. Please note that these ii categories of costs are examples of cost categories where a detail cost tin can be included in both. In this case, direct labor is included in both prime costs and conversion costs.

These toll classifications are common in businesses that produce large quantities of an detail that is then packaged into smaller, sellable quantities such as soft drinks or cereal. In these types of production environments, information technology easier to lump the costs of directly labor and overhead into ane category, since these costs are what are needed to catechumen raw materials into a finished product. This method of costing is termed process costing and is covered in Process Costing.

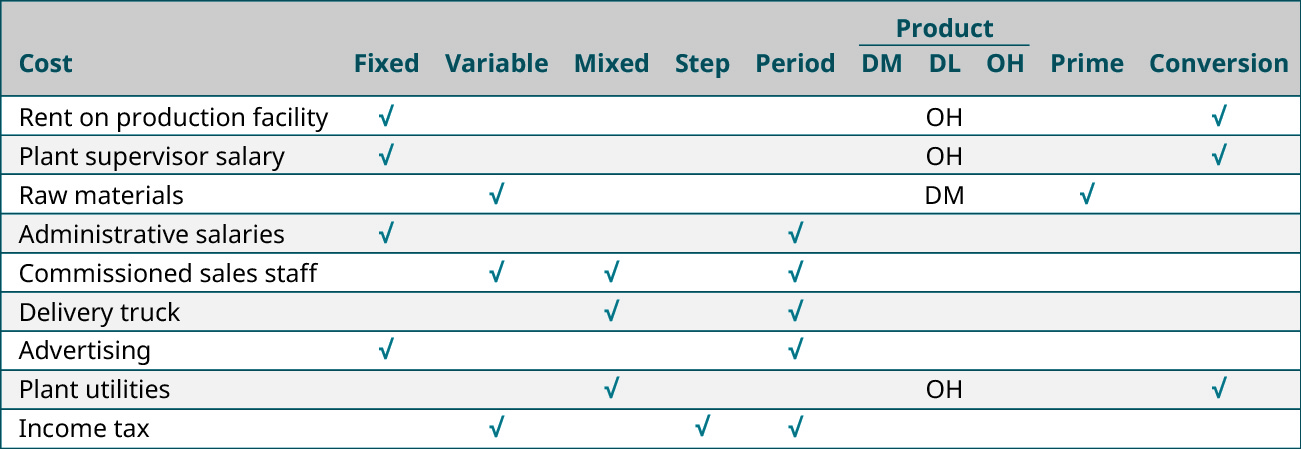

Although information technology seems equally if there are many classifications or labels associated with costs, remember that the purpose of cost classification is to assist managers in the decision-making process. Since this blazon of data is not used for external reporting purposes, information technology is important to understand that (1) a single cost can have many different labels; (2) the terms are used independently, not simultaneously; and (iii) each classification is of import to understand in club to make concern decisions. (Effigy) uses some instance costs to demonstrate these principles.

Classification Based on Cost Function. Costs can autumn into more than ane category, sometimes making the process of cost identification complex. DM, direct materials; DL, direct labor; OH, overhead. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA iv.0 license)

Furnishings of Changes in Activity Level on Unit Costs and Full Costs

We have spent considerable fourth dimension identifying and describing the various means that businesses categorize costs. Nonetheless, categorization itself is not enough. It is of import non only to understand the categorization of costs but to empathise the relationships betwixt changes in activity levels and the changes in costs in total. It is worth repeating that when a cost is considered to be fixed, that cost is just fixed for the relevant range. One time the boundary of the relevant range has been reached or moved beyond, fixed costs will change so remain fixed for the new relevant range. Remember that, inside a relevant range of activeness, where the relevant range refers to a specific action level that is bounded by a minimum and maximum amount, total fixed costs are abiding, just costs change on a per-unit of measurement footing. Allow'southward examine an example that demonstrates how changes in activeness tin affect costs.

Price Accounting Helps Reduce Fraud and Promotes Ethical Behavior

Managerial and related cost bookkeeping systems aid managers in making ethical and audio business concern decisions. Managerial accountants implement accounting reporting systems to minimize or prevent fraud and promote ethical decision-making. For example, tracking changes in costing action and ensuring that activity remains in a relevant range, helps ensure that an system's business organisation activity is properly bounded within a reasonable range of expense. If the minimum or maximum expense range is exceeded, this tin indicate that management is acting without authority or is pursuing unauthorized activities. Excessive costs may even exist a scarlet flag that possible fraud is occurring. Cost accounting helps ensure that fiscal costs are within an acceptable range and helps an organization make reliable forward-looking financial decisions.

Comprehensive Example of the Effect on Changes in Activity Level on Costs

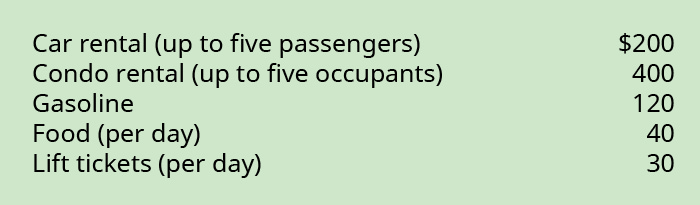

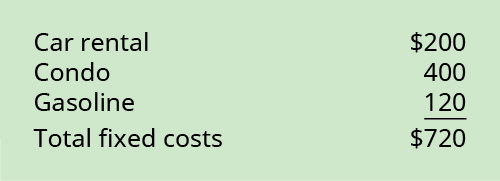

Pat is planning a three-day ski trip on his jump break after he works on a Habitat for Humanity project in Dallas. The costs for the trip are as follows:

He is considering his costs for the trip if he goes alone, or if he takes one, 2, 3, or four friends. However, before he can brainstorm his analysis, he needs to consider the characteristics of the costs. Some of the costs volition stay the aforementioned no matter how many people go, and some of the costs will fluctuate, based on the number of participants.

Those costs that do non change are the stock-still costs. In one case you incur a fixed price, it does non modify inside a given range. For example, Pat can take upwards to five people in one car, and then the cost of the automobile is fixed for upwards to five people. However, if he took more friends, then he would need more than cars. The condo rental and the gasoline expenses would also be considered stock-still costs, because they are not going to alter in the reference range.

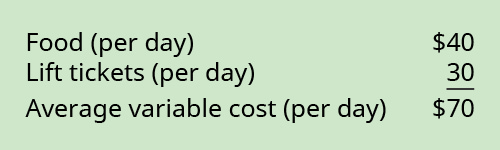

The costs that exercise change as the number of participants alter are the variable costs. The food and lift ticket expenses are examples of variable costs, since they fluctuate based upon the number of participants and the number of days of activities.

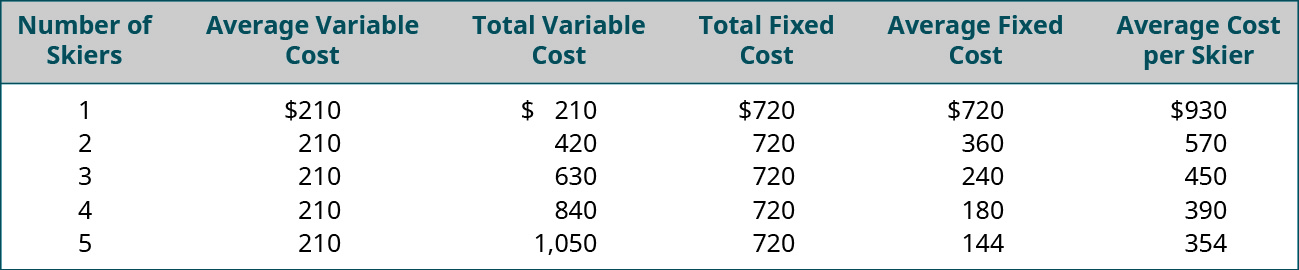

In analyzing the costs, Pat also needs to consider the total costs and average costs. The analysis will calculate the average stock-still costs, the total stock-still costs, the average variable costs, and the total variable costs.

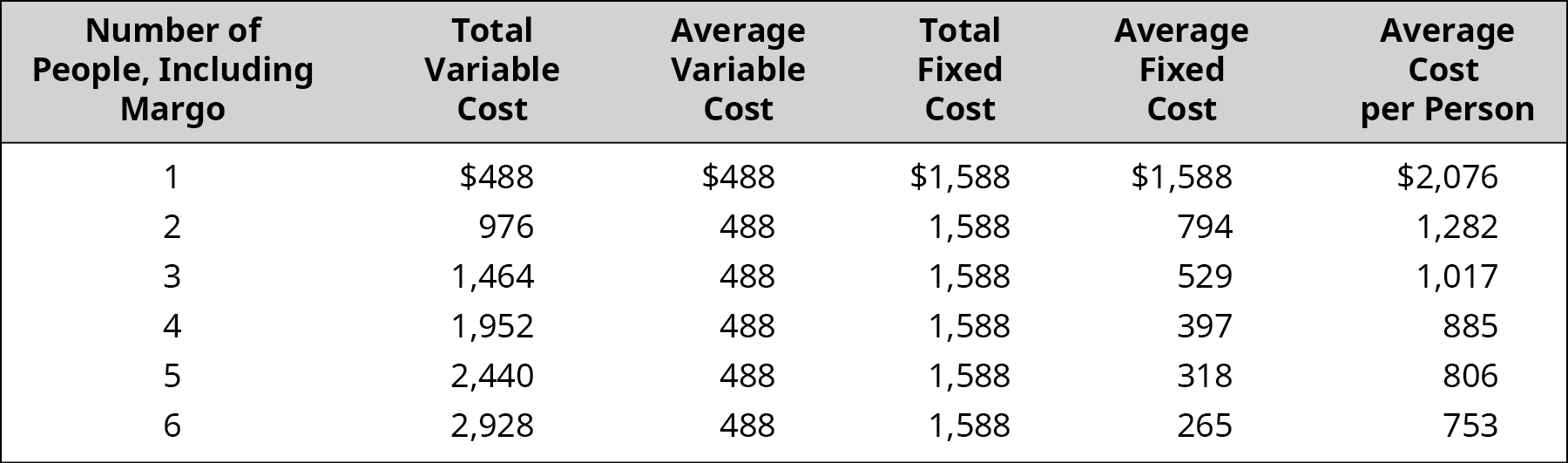

In the analysis of full costs versus boilerplate costs, both total and average fixed costs will stay the same and total and average variable costs will change. Here are the full fixed costs:

The full fixed costs for the trip will be ?720.00, no matter whether Pat goes lonely or takes up to 4 friends. Notwithstanding, the boilerplate fixed costs will be the total stock-still costs divided past the number of participants. The average fixed cost could range from ?720 (720/1) to ?144 (720/5).

Here are the variable costs:

The average variable cost volition be ?seventy.00 per person per solar day, no matter how many people go along the trip. However, the total variable costs volition range from ?seventy.00, if Pat goes solitary, to ?350.00, if five people go. (Figure) shows the relationships of the various costs, based on the number of participants.

Comprehensive Ski Trip Cost Classification. (attribution: Copyright Rice Academy, OpenStax, under CC Past-NC-SA 4.0 license)

Looking at this assay, it is articulate that, if there is an activity that you think that you cannot afford, it can become less expensive if you are creative in your toll-sharing techniques.

Bound Break Trip Planning

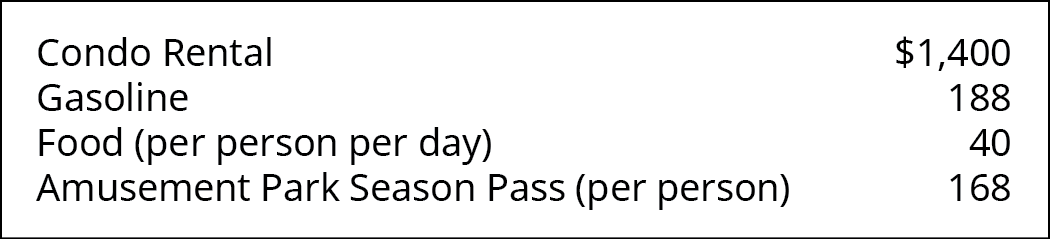

Margo is planning an 8-day leap break trip from Atlanta, Georgia, to Tampa, Florida, leaving on Sunday and returning the following Lord's day. She has located a condominium on the beach and has put a deposit down on the unit. The rental company has a maximum occupancy for the condominium of vii adults. There is an entertainment park that she plans to visit. She is going to use her parents' car, an SUV that tin can comport upwardly to 6 people and their luggage. The SUV tin travel an boilerplate of 20 miles per gallon, the total distance is approximately 1,250 miles (550 miles each way plus driving around Tampa every day), and the average price of gas is ?3 per gallon. A flavor pass for an amusement park she wants to visit is ?168 per person. Margo estimates spending ?xl per day per person for food. She estimates the costs for the trip as follows:

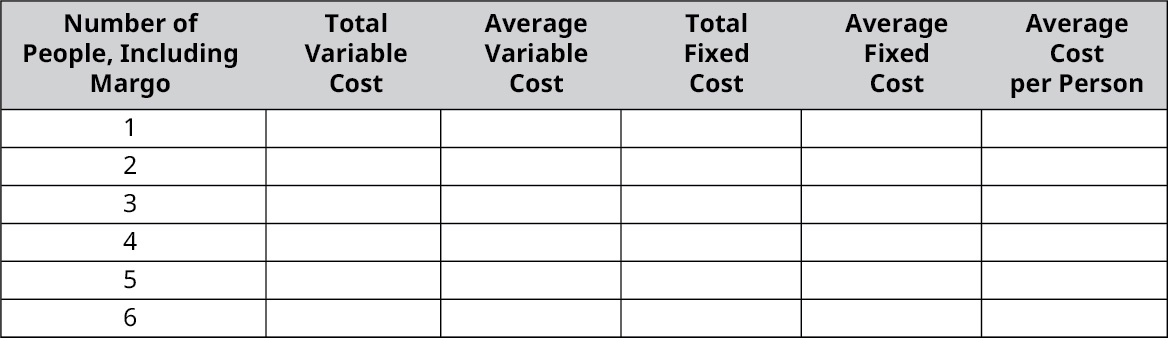

Now that she has price estimates, she is trying to decide how many of her friends she wants to invite. Since the car can just seat six people, Marg made a list of five other girls to invite. Employ her data to answer the following questions and make full out the cost tabular array:

- What are the total variable costs for the trip?

- What are the boilerplate variable costs for the trip?

- What are the full stock-still costs for the trip?

- What are the average fixed costs for the trip?

- What are the average costs per person for the trip?

- What would the trip cost Margo if she were to get solitary?

- What additional costs would exist incurred if a 7th daughter was invited on the trip? Would this be a wise decision (from a price perspective)? Why or why not?

- Which cost will not exist affected if a seventh daughter was invited on the trip?

Solution

Answers volition vary. All responses should recognize that there is no room in the machine for the seventh girl and her luggage, although the condominium will accommodate the extra person. This means they volition accept to either detect a larger vehicle and incur higher gas expenses or have a second car, which will at least double the stock-still gas cost.

Key Concepts and Summary

- Costs tin can be broadly classified every bit either stock-still or variable costs. All the same, in lodge for managers to manage effectively, these two cost classifications are often farther expanded to include mixed, step, prime, and conversion costs.

- For manufacturing firms, information technology is essential that they differentiate among direct materials, direct labor, and manufacturing overhead in order to identify and manage their total product costs.

- For planning purposes, managers must be conscientious to consider the relevant range because it is only within this relevant range that total fixed costs remain constant.

(Figure)Conversion costs include all of the following except:

- wages of product workers

- depreciation on factory equipment

- factory utilities

- directly materials purchased

D

(Figure)Which of the following is not considered a product cost?

- direct materials

- direct labor

- indirect materials

- selling expense

(Figure)Stock-still costs are expenses that ________.

- vary in response to changes in activity level

- remain abiding on a per-unit footing

- increase on a per-unit of measurement basis as activity increases

- remain constant as activity changes

D

(Figure)Variable costs are expenses that ________.

- remain abiding on a per-unit basis but alter in full based on activity level

- remain abiding on a per-unit basis and remain constant in total regardless of activity level

- decrease on a per-unit footing as activity level increases

- remain constant in total regardless of activity level within a relevant range

(Effigy)Full costs for ABC Distributing are ?250,000 when the activity level is 10,000 units. If variable costs are ?five per unit, what are their fixed costs?

- ?240,000

- ?200,000

- ?260,000

- Their fixed costs cannot be adamant from the data presented.

B

(Figure)Which of the post-obit would non be classified every bit manufacturing overhead?

- indirect materials

- indirect labor

- direct labor

- holding taxes on factory

(Figure)Which of the following are prime costs?

- indirect materials, indirect labor, and direct labor

- straight labor, indirect materials, and indirect labor

- direct labor and indirect labor

- directly labor and direct materials

D

(Figure)Which of the post-obit statements is true regarding average fixed costs?

- Average stock-still costs per unit remain fixed regardless of level of activity.

- Boilerplate fixed costs per unit ascension every bit the level of activity rises.

- Boilerplate stock-still costs per unit fall equally the level of activeness rises.

- Average stock-still costs per unit cannot be adamant.

(Effigy)Identify and depict the 3 types of product costs in a manufacturing firm.

Answers will vary just must include directly materials, straight labor, and manufacturing overhead.

(Figure)Explain the difference between a flow cost and a product cost.

(Figure)Explain the concept of relevant range and how it affects full fixed costs.

Answers will vary merely should include that fixed costs remain fixed in total across the relevant range, bounded by a minimum and maximum activity level.

(Figure)Explain the differences among stock-still costs, variable costs, and mixed costs.

(Figure)Explicate the deviation betwixt prime costs and conversion costs.

Answers will vary only should include that prime costs are the direct cloth and direct labor costs, and conversion costs are direct labor and general manufacturing plant overhead combined.

(Figure)Hicks Contracting collects and analyzes toll information in order to track the price of installing decks on new home construction jobs. The following are some of the costs that they incur. Classify these costs as fixed or variable costs and every bit product or period costs.

- Lumber used to construct decks (?12.00 per square pes)

- Carpenter labor used to construct decks (?10 per hour)

- Construction supervisor salary (?45,000 per year)

- Depreciation on tools and equipment (?half dozen,000 per year)

- Selling and administrative expenses (?35,000 per year)

- Hire on corporate office space (?34,000 per year)

- Nails, glue, and other materials required to construct deck (varies per job)

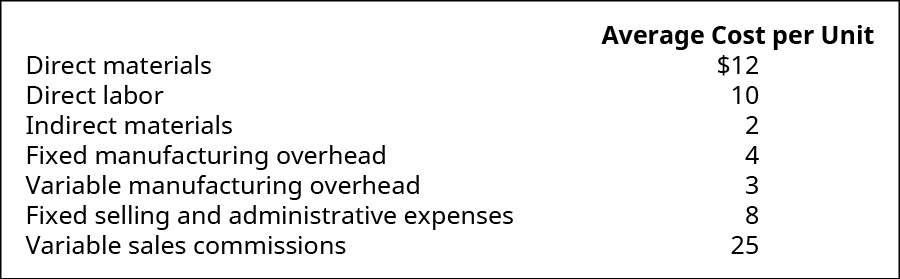

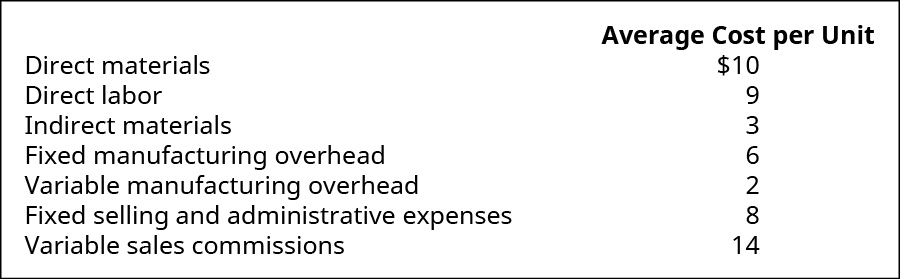

(Figure)Rose Company has a relevant range of production between 10,000 and 25,000 units. The following cost information represents average toll per unit for fifteen,000 units of product.

Using the price data from Rose Company, answer the following questions:

- If 10,000 units are produced, what is the variable cost per unit?

- If 18,000 units are produced, what is the variable toll per unit of measurement?

- If 21,000 units are produced, what are the total variable costs?

- If 11,000 units are produced, what are the total variable costs?

- If 19,000 units are produced, what are the total manufacturing overhead costs incurred?

- If 23,000 units are produced, what are the full manufacturing overhead costs incurred?

- If nineteen,000 units are produced, what are the per unit of measurement manufacturing overhead costs incurred?

- If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred?

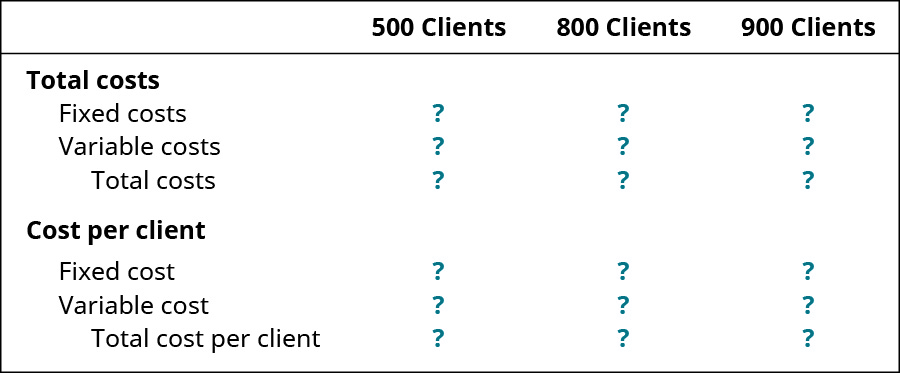

(Figure)Carr Company provides human resource consulting services to small- and medium-sized companies. Last year, Carr provided services to 700 clients. Full fixed costs were ?159,000 with total variable costs of ?87,500. Based on this data, complete this chart:

(Effigy)Western Trucking operates a fleet of delivery trucks. The fixed expenses to operate the fleet are ?79,900 in March and rose to ?93,120 in April. It costs Western Trucking ?0.15 per mile in variable costs. In March, the commitment trucks were driven a total of 85,000 miles, and in April, they were driven a total of 96,000 miles. Using this information, reply the following:

- What were the full costs to operate the fleet in March and April, respectively?

- What were the cost per mile to operate the armada in March and April, respectively?

(Effigy)Suppose that a company has stock-still costs of ?18 per unit and variable costs ?nine per unit when 15,000 units are produced. What are the fixed costs per unit when 12,000 units are produced?

Roper Furniture manufactures function furniture and tracks cost data across their procedure. The following are some of the costs that they incur. Classify these costs every bit fixed or variable costs, and as product costs or period costs.

- Wood used to produce desks (?125.00 per desk)

- Product labor used to produce desks (?15 per hour)

- Production supervisor bacon (?45,000 per twelvemonth)

- Depreciation on factory equipment (?60,000 per year)

- Selling and administrative expenses (?45,000 per year)

- Rent on corporate role (?44,000 per year)

- Nails, mucilage, and other materials required to produce desks (varies per desk)

- Utilities expenses for production facility

- Sales staff commission (5% of gross sales)

(Figure)Baxter Company has a relevant range of product between 15,000 and xxx,000 units. The post-obit cost data represents average variable costs per unit of measurement for 25,000 units of production.

Using the costs data from Rose Company, reply the following questions:

- If 15,000 units are produced, what is the variable cost per unit of measurement?

- If 28,000 units are produced, what is the variable cost per unit?

- If 21,000 units are produced, what are the total variable costs?

- If 29,000 units are produced, what are the total variable costs?

- If 17,000 units are produced, what are the total manufacturing overhead costs incurred?

- If 23,000 units are produced, what are the full manufacturing overhead costs incurred?

- If 30,000 units are produced, what are the per unit manufacturing overhead costs incurred?

- If fifteen,000 units are produced, what are the per unit manufacturing overhead costs incurred?

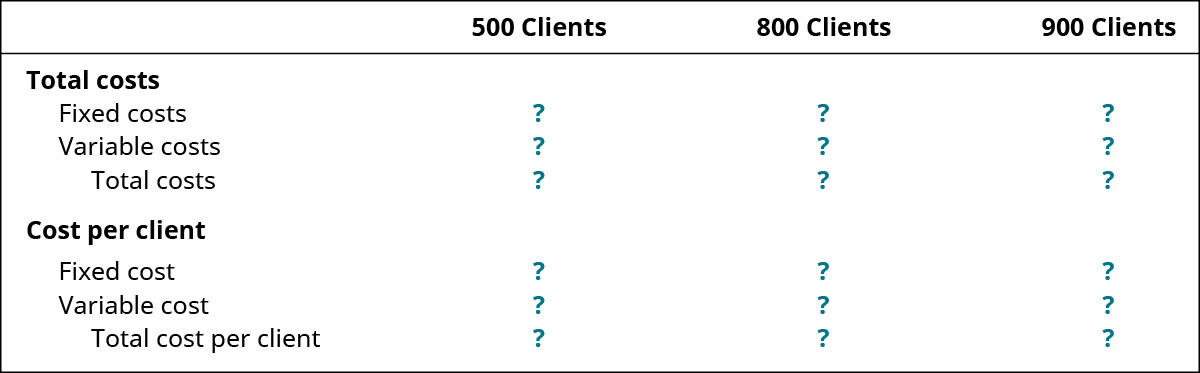

(Figure)Sanchez & Vukmin, LLP, is a full-service accounting business firm located about Chicago, Illinois.

Terminal twelvemonth, Sanchez provided tax preparation services to 500 clients. Total fixed costs were ?265,000 with total variable costs of ?180,000. Based on this data, complete this chart.

(Figure)Case Airlines provides lease airline services. The fixed expenses to operate the visitor's aircraft are ?377,300 in January and ?378,880 in February. It costs Case Airlines ?0.45 per mile in variable costs. In Jan, Case shipping flew a total of 385,000 miles, and in February, Example aircraft flew a full of 296,000 miles. Using this data, answer the following:

- What were the total costs to operate the aircraft in January and Feb, respectively?

- What were the full costs per mile to operate the armada in January and February, respectively?

(Figure)Suppose that a company has fixed costs of ?11 per unit and variable costs ?6 per unit when 11,000 units are produced. What are the stock-still costs per unit when xx,000 units are produced?

(Effigy)Listed as follows are diverse costs establish in businesses. Allocate each toll every bit a fixed or variable cost, and every bit a product and/or period price.

- Wages of administrative staff

- Shipping costs on merchandise sold

- Wages of workers assembling computers

- Cost of charter on factory equipment

- Insurance on mill

- Direct materials used in production of lamps

- Supervisor salary, factory

- Advert costs

- Property taxes, manufactory

- Health insurance price for company executives

- Hire on factory

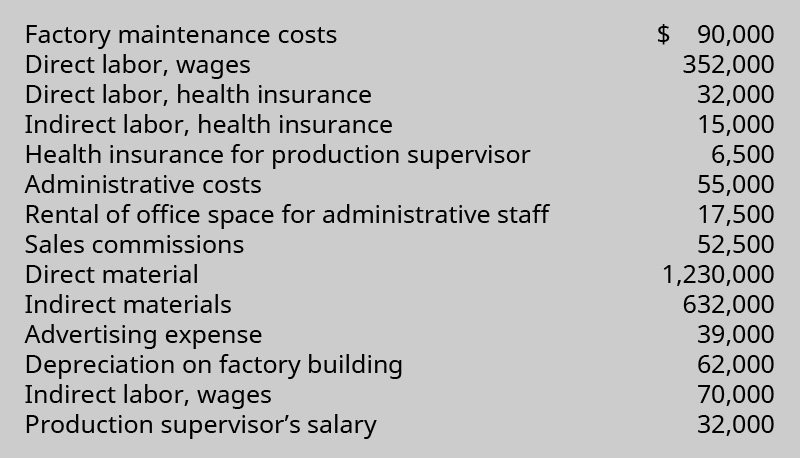

(Figure)Wachowski Company reported these cost data for the year 2017.

Apply the data to complete the following table.

| Total prime costs | |

| Total manufacturing overhead costs | |

| Total conversion costs | |

| Total product costs | |

| Full period costs |

(Effigy)Pocket Umbrella, Inc, is because producing a new type of umbrella. This new pocket-size umbrella would fit into a glaze pocket or purse. Classify the following costs of this new product as direct materials, straight labor, manufacturing overhead, or selling and administrative.iii

- Cost of advertisement the production

- Fabric used to make the umbrellas

- Maintenance of cutting machines used to cut the umbrella fabric then it will fit the umbrella frame

- Wages of workers who gather the production

- President'due south bacon

- The salary of the supervisor of the people who get together the product

- Wages of the product tester who stands in a shower to make sure the umbrellas do non leak

- Price of marketplace research survey

- Salary of the company'southward sales managers

- Depreciation of administrative office building

(Effigy)Using the costs listed in the previous problem, allocate the costs equally either production costs or period costs.

(Figure)This list contains costs that various organizations incur; they fall into three categories: straight materials (DM), direct labor (DL), or overhead (OH).4

- Classify each of these items as direct materials, direct labor, or overhead.

- Glue used to attach labels to bottles containing a patented medicine.

- Compressed air used in operating paint sprayers for Student Painters, a company that paints houses and apartments.

- Insurance on a factory building and equipment.

- A production section supervisor'south salary.

- Rent on factory mechanism.

- Iron ore in a steel manufactory.

- Oil, gasoline, and grease for forklift trucks in a manufacturing company'southward warehouse.

- Services of painters in building construction.

- Cut oils used in machining operations.

- Toll of paper towels in a factory employees' washroom.

- Payroll taxes and fringe benefits related to directly labor.

- The institute electricians' salaries.

- Crude oil to an oil refinery.

- Copy editor's salary in a book publishing company.

- Presume your classifications could exist challenged in a court example. Signal to your attorneys which of your answers for part a might be successfully disputed past the opposing attorneys and why. In which answers are you lot completely confident?

Footnotes

- 1"Ethics Center." Plant of Direction Accountants. https://www.imanet.org/career-resources/ideals-center?ssopc=1

- iiAttribution: Modification of work past Sharon Kioko and Justin Marlowe. "Cost Analysis." Financial Strategy for Public Managers. CC By 4.0. https://press.rebus.community/financialstrategy/chapter/price-analysis/

- threeAttribution: Modification of work past Roger Hermanson, James Edwards, and Michael Maher. Bookkeeping Principles: A Business Perspective. 2011, CC By. Source: Available at https://open.umn.edu/opentextbooks/textbooks/383.

- ivAttribution: Modification of piece of work by Roger Hermanson, James Edwards, and Michael Maher. Accounting Principles: A Concern Perspective. 2011, CC By. Source: Bachelor at https://open up.umn.edu/opentextbooks/textbooks/383.

Glossary

- average fixed cost (AFC)

- total stock-still costs divided past the total number of units produced, which results in a per-unit of measurement toll

- boilerplate variable cost (AVC)

- total variable costs divided by the full number of units produced, which results in a per-unit toll

- conversion costs

- total of labor and overhead for a product; the costs that "convert" the direct fabric into the finished production

- price driver

- action that is the reason for the increase or subtract of some other toll; examples include labor hours incurred, labor costs paid, amounts of materials used in product, units produced, or any other activity that has a cause-and-effect human relationship with incurred costs

- fixed toll

- unavoidable operating expense that does non change in total, regardless of the level of action

- indirect labor

- labor not directly involved in the active conversion of materials into finished products or the provision of services

- indirect materials

- materials used in product simply not efficiently traceable to a specific unit of measurement of production

- mixed costs

- expenses that have a fixed component and a variable component

- flow costs

- typically related to a particular time period instead of attached to the production of an asset; treated every bit an expense in the flow incurred (examples include many sales and administrative expenses)

- prime costs

- direct material expenses and direct labor costs

- production costs

- all expenses required to manufacture the product: straight materials, directly labor, and manufacturing overhead

- relevant range

- quantitative range of units that can exist produced based on the company's current productive assets; for example, if a company has sufficient stock-still assets to produce upwards to 10,000 units of product, the relevant range would be between 0 and ten,000 units

- stepped price

- 1 that changes with the level of action but will remain constant inside a relevant range

- total price

- sum of all fixed and all variable costs

- full fixed costs

- sum of all fixed costs

- full variable costs

- sum of all variable costs

- variable cost

- i that varies in straight proportion to the level of activity inside the business organisation

Are Fixed Costs That Management Has Little Or No Control Over In The Short Run.,

Source: https://opentextbc.ca/principlesofaccountingv2openstax/chapter/identify-and-apply-basic-cost-behavior-patterns/

Posted by: stoverhoatherand.blogspot.com

0 Response to "Are Fixed Costs That Management Has Little Or No Control Over In The Short Run."

Post a Comment